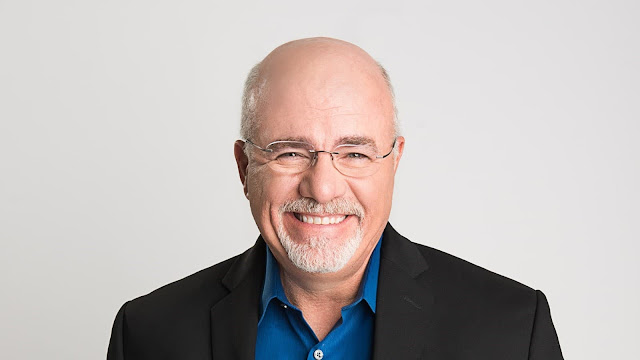

David Lawrence Ramsey III, popularly known as Dave Ramsey, (born

1960) is an American personal finance personality, radio talk show host,

author, and businessman. He hosts the nationally syndicated radio show The

Ramsey Show. Ramsey has written several books, including the New York Times

bestseller Total Money Makeover, and Entrepreneurship, and hosted a television

show on Fox Business from 2007 to 2010.

Dave Ramsey was 26 years old when he started earning a quarter

of a million dollars a year and by then already had a real estate portfolio of

$4 million. Although, he lost everything two years later.

Today, 60-year-old Ramsey is considered one of the most trusted

financial advisers with a podcast, The Dave Ramsey Show, ranked as one of the

top five talk shows in the United States, with 13 million listeners each week

in over 600 radio stations.

Ramsey also founded The Lampo Group, a personal finance

consulting firm. His money management class started with 37 students, but after

a few years, enrollment had warned more than 350 students.

Following the success of The Lampo Group, Ramsey began

co-hosting The Money Game, a radio show focused on personal finance, with his

friend Roy Matlock. At the same time, he released his first book, Financial

Peace, and got his growing radio audience to help sell it.

Ramsey then launched The Dave Ramsey Show, a spin-off radio

show. People from all over the country call to ask Ramsey a variety of personal

finance questions in each episode.

How did Dave Ramsey make his fortune?

Ramsey began selling property after graduating from college, in

part because he was able to secure financing for his businesses through family

connections at local banks. His real estate portfolio was worth $4 million at

the age of 26, and his net worth was just over $1 million.

But his initial success was fleeting, and he ended up filing for

personal bankruptcy protection at the age of 28 in 1988, due to the acquisition

of his largest lender, to whom he owed $1.2 million, by a larger bank. The bank

required Ramsey to pay off the entire debt within 90 days. Another bank called

him for $800,000 shortly after receiving his first notice of demand. Ramsey was

able to pay off most of the debt, leaving $378,000 in debt.

Since filing for personal bankruptcy in his early years, Dave

Ramsey, now with an estimated net worth of $200 million, has come a long way,

and could be considered living proof that anyone can turn a bad financial

situation around. Ramsey made his first million, lost it, and then quickly

rebuilt an even bigger fortune.

Ramsey is open about his investment strategy. He advises his

followers to avoid investing in individual stocks and instead invest in mutual

funds with long histories of good performance. Its equity investments fall into

four categories: growth, growth and income, aggressive growth, and

international.

Dave Ramsey also has a portfolio

of rental properties in addition to mutual funds. His real estate investment

philosophy is based on buying properties without resorting to debt financing.

Dave Ramsey's 7 Small Steps

Baby Step 1: Save $1,000 in an emergency fund

The baby's first step in Ramsey's plan is to save $1000 in a

savings account. Dave Ramsey's baby steps plan is designed for people who live

paycheck to paycheck, which means they constantly spend the money they earn on

everyday expenses and live from payday to payday without leaving room to save

anything. of what they do.

Baby Step 2: Pay off all debts (except the house) using the

debt snowball

Dave Ramsey's Baby Steps Plan recommends paying off all debt

except your mortgage or other home loan, using what's called a debt snowball.

What this means is that you start with your smallest debt and use the extra money

to pay it off as quickly as possible.

Once you've paid off one of these lower balance accounts,

transfer your balance to another similar account (or add $50 if necessary) to

continue reducing higher balances.

The idea behind Dave Ramsey's baby steps plan is that by

targeting the smallest debts first, people can feel victorious after each

victory, leading them to continue their good progress instead of getting

discouraged because they don't see results. immediately or losing steam.

Baby Step 3: Save 3-6 months of expenses in an emergency

fund

Some people don't think about including emergency savings in

their budget because they can't afford it yet. But if you never have an

emergency fund, then the reality is that your credit cards or personal loans

will be your last resort when the unexpected happens, which means that even a

small problem could quickly spiral out of control and turn into a financial

disaster in no time. full rule. for those who do not have money saved for

emergencies.

Dave Ramsey's Baby Steps Plan recommends saving three to six

months worth of expenses as soon as possible and keeping this money separate

from funds used in other parts of life (i.e. groceries). The reason behind this

strategy is that it doesn't matter what event comes up at work, home, or

otherwise.

Baby Step 4: Invest

15% of your household income for retirement

Dave Ramsey's Baby Steps Plan recommends saving three to six

months worth of expenses as soon as possible and keeping this money separate

from funds used in other parts of life (i.e. groceries). The reason behind this

strategy is that it doesn't matter what event comes up at work, home, or

otherwise.

The key to successful Dave Ramsey baby steps is making sure you

have a safety net in case something goes wrong, because the reality is that

eventually everything will go wrong without any preparation. If something

happens, your credit cards can take care of things while you get back on track

by following Dave.

Baby Step 5: Save for

your children's college fund

In this step, you have paid off all your debts and are now

saving for your children's college fund. Dave Ramsey small steps. This is not

an easy task to do and will require a lot of work on the part of the parent,

but if you start early enough it can be done.

Baby Step 6: Pay off

your house early

These small Dave Ramsey steps will depend on your current

financial situation, but if you're doing the small Dave Ramsey steps, then of

course this is a goal! Paying off the house early means there is no mortgage to

pay and also provides more cash for retirement. This can be accomplished by

refinancing or simply making additional monthly payments.